Social Security increases its benefit checks over time with a cost of living adjustment (COLA).

This increase is based on one version of the Consumer Price Index, which measures how much inflation has affected the prices that consumers pay for goods and services. This version doesn’t actually keep in line with the reality of seniors’ experiences with inflation.

Usually, the COLA is relatively small, but the increase for 2023 was 8.7 percent due to higher inflation. Here’s the level of adjustments that recipients have enjoyed over the past decade.

| Year | COLA increase | Year | COLA increase |

|---|---|---|---|

| 2023 | 8.7% | 2018 | 2.0% |

| 2022 | 5.9% | 2017 | 0.3% |

| 2021 | 1.3% | 2016 | 0% |

| 2020 | 1.6% | 2015 | 1.7% |

| 2019 | 2.8% | 2014 | 1.5% |

Source: Social Security Administration

So what would your total check be if you started with a $1,000 benefit in 2013? You’d be receiving $1,286.20 in 2023.

What is the maximum monthly Social Security benefit?

The most you could receive from Social Security depends on a few factors: how much you’ve earned over your working life, when you begin to take your benefits, and your COLA increase. Over time your benefits will increase if the COLA indicates an increase.

The maximum initial monthly benefit for 2023 by retirement age:

- At age 62: $2,572

- At age 65: $3,279

- At age 66: $3,506

- At age 70: $4,555

These figures assume a worker had steady earnings at the maximum taxable level since age 22. For 2023, maximum taxable income is $160,200, a number that usually rises each year.

Your benefit depends on how much you’ve earned, up to some maximum each year. And taking your benefit later in your life can also increase it substantially. Workers are able to claim a benefit early, at age 62, if they’ve contributed 10 years of work, before they reach what’s called full retirement age, which can range from 65 to 67, depending on when you were born.

If you claim early benefits, your check will be less than it otherwise could be at full retirement or even later. If you wait until age 70 to claim benefits, you’ll receive still more each month.

To receive these benefits, you pay Social Security taxes of 6.2 percent on your income, up to the maximum tax income. Your employer pays another 6.2 percent of your salary into the fund, but if you’re self-employed you foot that portion of the tax bill, too.

Bottom line

The average Social Security check was never meant to replace a retired worker’s full income, and so it’s important that Social Security be part of your overall retirement plan, not your single source of income. If you have years to go before retirement, it’s vital that you get started on saving and investing while you still have time working in your favor.

☆☆☆

IN GOD WE TRUST

Thanks for supporting independent true journalism with a small tip. Dodie & Jack

Use Code CLEVER10 for a 10% discount on Green Pasture products today!

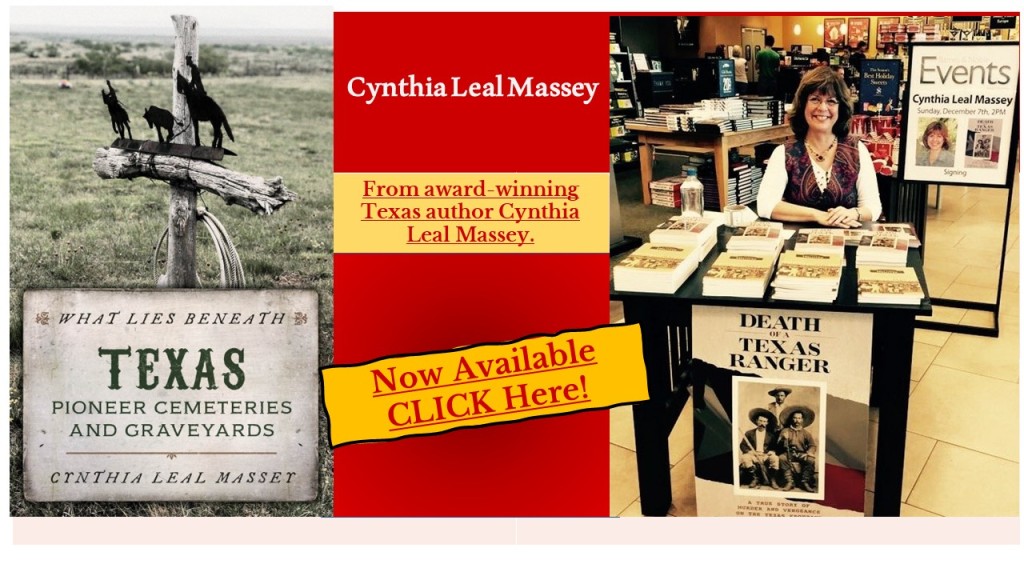

CINDY LEAL MASSEY, TEXAS AUTHOR

It doesn’t keep up. Illegal aliens make more than the top social security pays out. What a disgrace.

LikeLiked by 2 people

Yes, it’s pathetic.

LikeLiked by 1 person

💙

LikeLike

I am still trying to decide when to start collecting from social security.

LikeLiked by 2 people

We both elected to do it as soon as we could. No regrets.

LikeLike

Thank you! If you retire at 62, how does that affect the COLAS? The internet has a variety of answers from not getting it to reduced to full COLA. It is confusing. I sent an email to Social Security and they sent a response about 2 months later with a form letter that did not answer any of my questions.

LikeLike